The Natco Pharma share price has been drawing steady attention from investors, traders, and market analysts alike. If you follow the Indian pharmaceutical sector, you already know that Natco Pharma is a strong mid-cap player with a solid reputation in oncology and specialty medicines. Naturally, its stock performance often reflects both company fundamentals and broader healthcare trends.

In recent years, the pharmaceutical industry in India has experienced significant growth. Rising exports, increased healthcare awareness, and government support have contributed to sectoral momentum. As a result, the Natco Pharma share price has seen phases of both sharp rallies and healthy corrections. These movements are not random. They are usually driven by quarterly earnings, product approvals, regulatory developments, and global demand.

Investors often ask a simple question: Is the Natco Pharma share price worth watching right now? The answer depends on your investment horizon. Short-term traders may focus on price momentum and technical indicators. Long-term investors, however, often look at earnings growth, debt levels, and product pipelines.

Another factor that influences the Natco Pharma share price is its exposure to international markets. The company generates significant revenue from exports, especially the US market. Therefore, changes in USFDA regulations and global pricing policies can directly impact stock performance.

Overall, the stock reflects a blend of stability and growth potential. For investors looking at pharmaceutical stocks in India, Natco Pharma remains a name that deserves careful attention.

Historical Performance of Natco Pharma Share Price

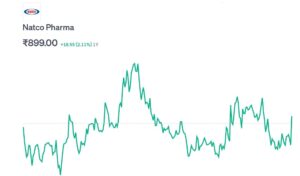

Looking at the historical performance of the Natco Pharma share price gives us valuable insights. Over the past decade, the stock has delivered impressive returns during bullish phases. However, like most mid-cap stocks, it has also experienced volatility during market corrections.

During strong earnings years, the Natco Pharma share price has surged significantly. Positive quarterly results often act as catalysts. When revenue and profit margins expand, investor confidence rises quickly. On the other hand, weaker results or regulatory concerns can temporarily pull the stock down.

One interesting aspect is how the stock reacts to product approvals. Whenever Natco receives approval for a key generic drug, especially in regulated markets, the share price often responds positively. Investors interpret these approvals as signs of future revenue growth.

The COVID-19 period also influenced the Natco Pharma share price. Pharmaceutical stocks gained attention as healthcare became a global priority. Although Natco is not primarily a vaccine manufacturer, overall sector optimism benefited its valuation.

Here’s a simplified overview of the stock’s historical movement:

| Year Range | Trend Direction | Key Drivers |

| 2014-2017 | Strong Uptrend | Earnings growth, export expansion |

| 2018-2019 | Correction Phase | Regulatory pressures |

| 2020-2021 | Recovery Rally | Pharma sector boom |

| 2022-2023 | Consolidation | Market volatility |

Historical performance does not guarantee future results. Still, it helps investors understand patterns and market behavior related to the Natco Pharma share price.

Related News: Kwality Walls Share Price

Key Factors Affecting Natco Pharma Share Price

Several factors directly impact the Natco Pharma share price. Understanding these elements can help you make informed decisions.

- Quarterly Earnings

Earnings reports are one of the biggest drivers. Strong revenue growth and stable margins often push the stock upward. Weak results, however, can trigger selling pressure.

- USFDA Approvals

Natco Pharma depends heavily on regulated markets. When the company secures USFDA approvals, investor sentiment improves. Conversely, inspection issues may create short-term uncertainty.

- Product Pipeline

The strength of the company’s product pipeline plays a major role. A robust pipeline suggests long-term growth. Investors closely monitor new drug launches and filings.

- Global Demand for Generics

Generic drug demand in international markets significantly affects earnings. Pricing pressure in the US market can influence the Natco Pharma share price.

- Market Sentiment

Broader market conditions also matter. During bullish trends, mid-cap pharma stocks often outperform. In bearish markets, even fundamentally strong stocks may decline temporarily.

Because of these factors, the Natco Pharma share price rarely moves in isolation. It reacts to both internal performance and external market dynamics.

Fundamental Analysis of Natco Pharma

When evaluating the Natco Pharma share price, fundamental analysis provides deeper clarity. Investors often examine financial ratios, debt levels, and profit margins before making a decision.

Natco Pharma has historically maintained healthy operating margins. This indicates efficient cost management. In addition, its focus on niche therapeutic areas, especially oncology, gives it a competitive edge.

Here are some key fundamentals investors typically review:

- Revenue Growth Rate

- Net Profit Margin

- Return on Equity (ROE)

- Debt-to-Equity Ratio

- Earnings Per Share (EPS)

A company with consistent revenue growth and manageable debt tends to attract long-term investors. Natco Pharma’s relatively strong balance sheet often supports its valuation.

Moreover, management guidance plays a crucial role. If company leadership projects positive growth, the Natco Pharma share price often reflects that optimism. Transparency in financial reporting also strengthens investor trust.

Fundamental strength does not eliminate risk. However, it reduces uncertainty and builds long-term confidence in the stock.

Technical Analysis of Natco Pharma Share Price

While fundamentals matter, technical analysis helps traders identify entry and exit points. The Natco Pharma share price often shows recognizable chart patterns.

Traders frequently look at:

- 50-day Moving Average

- 200-day Moving Average

- Relative Strength Index (RSI)

- Support and Resistance Levels

- Volume Trends

If the stock trades above its 200-day moving average, it is often considered bullish. On the other hand, repeated failures at resistance levels may signal caution.

Volume also tells a story. High trading volume during price increases indicates strong buying interest. Meanwhile, falling prices with high volume may suggest selling pressure.

Technical indicators are not foolproof. However, they provide helpful signals for short-term traders focusing on the Natco Pharma share price.

Natco Pharma Share Price Forecast

Predicting the exact future of the Natco Pharma share price is impossible. However, we can analyze trends and growth drivers to form reasonable expectations.

If the company continues expanding its product portfolio and securing international approvals, growth prospects remain positive. Rising global demand for affordable generics also supports long-term expansion.

Analysts typically consider:

- Upcoming product launches

- Revenue guidance

- Market share growth

- Industry outlook

Short-term volatility is always possible. Market corrections, global economic concerns, or regulatory delays can influence stock performance. However, long-term investors often focus on earnings consistency rather than daily fluctuations.

The pharmaceutical sector in India continues to grow steadily. Therefore, if Natco maintains its competitive position, the Natco Pharma share price may reflect sustainable growth over time.

Is Natco Pharma Share Price a Good Investment?

Whether the Natco Pharma share price is suitable for your portfolio depends on your risk profile and goals. Mid-cap pharmaceutical stocks typically offer higher growth potential but also moderate volatility.

If you are a long-term investor seeking exposure to the healthcare sector, Natco Pharma can be considered after proper research. Its focus on niche products and global exports provides diversification benefits.

However, investors should:

- Monitor quarterly results regularly.

- Track regulatory developments.

- Diversify across sectors.

- Avoid emotional decisions during short-term volatility.

No stock is risk-free. Still, with disciplined research and patience, the Natco Pharma share price can form part of a balanced portfolio strategy.

Conclusion

The Natco Pharma share price remains an important indicator within the Indian pharmaceutical sector. Its performance reflects earnings growth, product approvals, regulatory updates, and broader market sentiment. While the stock has experienced both rallies and corrections, its strong fundamentals and export-driven model continue to attract investor attention.

For those interested in pharma stocks, Natco Pharma deserves careful analysis. Always combine fundamental and technical insights before investing. With a balanced approach, you can make informed decisions in an ever-changing market environment.

Frequently Asked Questions (FAQs)

- What affects Natco Pharma share price the most?

Quarterly earnings, USFDA approvals, and global generic drug demand significantly influence the stock.

- Is Natco Pharma a long-term investment?

It can be suitable for long-term investors who believe in the pharmaceutical sector’s growth.

- Does Natco Pharma pay dividends?

The company has paid dividends in certain years, depending on profitability.

- Why is Natco Pharma share price volatile?

Mid-cap stocks react to earnings, regulatory updates, and overall market trends.

- Where can I check the latest Natco Pharma share price?

You can track it on NSE, BSE, or trusted financial news platforms.